Repo with the Bank of Russia

FEATURES

Member firms are admitted to repo trades with the Bank of Russia is they meet the following criteria:

- they are credit institutions;

- they have signed appropriate agreements with the Bank of Russia;

- they act on their own behalf and at their own expenses.

The Bank of Russia sets repo auction parameters and limits:

- list of eligible securities out of the Lombard List;

- order attributes: repo maturity, eligible settlement codes, initial haircut, lower and upper bounds of the haircut by repo maturity and currency, repo rate.

Repo trades with the Bank of Russia are executed as repo auctions or fixed rate repos.

Settlements in RUB Settlements in USD and EUR Repo auction

- Repo auction with settlement in RUB

Trading mode code: FBCB

- Repo auction with settlement in USD

Trading mode code: FBCU- Repo auction with settlement in EUR

Trading mode code: FBCEFixed rate repo

- Fixed rate repo with settlement in RUB

Trading mode code: FBFX

PARAMETERS:

- Bank of Russia is a counterparty to trades

- Currency: RUB, USD or EUR

- Eligible settlement codes: S0-S5, Rb, Z0

- Repo term: 1-365 days

- Bank of Russia sets parameters for available transactions

- Fees are charged according to the fee schedule selected by the member firm for executing repo transactions. The commission fee is converted into RUB at the Bank of Russia’s exchange rate of the settlement currency against the rouble as of the repo transaction date.

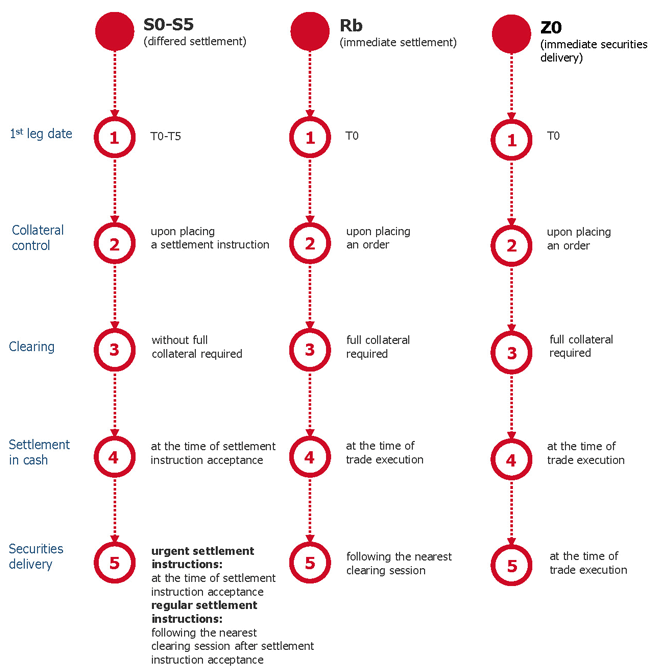

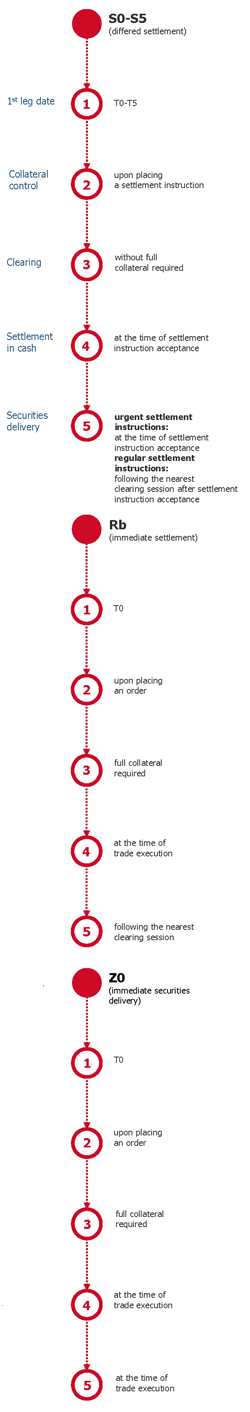

Settlement codes

Execution of the 1st leg:

Execution of the 2nd leg:

- 2nd leg of repo is executed only by submitting a settlement instruction

- 2nd leg of repo may be netted with the first leg of a new repo trade

- Settlement in securities under 2nd leg is done either following the nearest clearing session after settlement instruction, or immediately ("urgent settlement instruction")

- Settlement in cash is done immediately

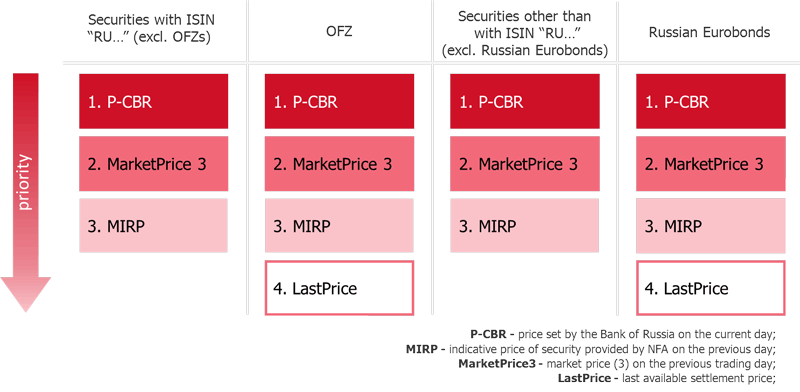

Price use procedure effective 21 November 2017:

ON-EXCHANGE REPO WITH THE BANK OF RUSSIA AND COLLATERAL MANAGEMENT BY NSD

- Orders are placed and trades are executed via exchange terminal

- New codes are available for 1st legs of RUB repo trades: DVP1, DVP3

- RUB repo auctions and fixed rate repos are available

- Basket repo with the Bank of Russia, which covers securities included on the CBR Lombard List and accepted as collateral for direct repo with the Bank of Russia

- Additional securities identifier (sub-basket) or security may be indicated for selecting in collateral with priority

- The Bank of Russia sets repo terms (1D-12M) are set by the Bank of Russia

- The Bank of Russia sets haircuts

- Clearing by NSD: multilateral netting for DVP3 settlement of 1st and 2nd legs of trades

- Four clearing sessions: 12:00, 14:00, 16:00, and 19:40 (Moscow time)

- Collateral management by NSD: automatic collateral selection, re-evaluation of obligations, margining, collateral substitution, return of income on securities

- Partial execution of the 1st repo trade leg

- Rollover of the 2nd leg of repo in case of default on settlement

CONTACT DETAILS:

For any queries, please contact our Repo and Deposit & Credit Operations team.

Telephone: +7 (495) 363-3232, ext. 5424, 5398, 5396, 5455

e-mail: repo@moex.com