"Iceberg" orders

Iceberg order is a simple limited order, in which the total number of contracts and their "visible" number are stipulated. This order type appears in the order book by turns. After the settlement of the visible part, the next amount emerges. The process repeats until the whole hidden part is finished.

ICEBERG ORDER OPPORTUNITIES

- Block trading

Iceberg order enables to conceal a certain part of its amount from the market (in the order book) in order to minimize the impact of relatively large orders on the market price. Thus, an iceberg order eliminates the negative impact of large orders on the market.

- Liquidity

There are no separate order books for Iceberg orders. Iceberg orders get into the order book of general instruments. Order settlement depends on the liquidity of a certain instrument.

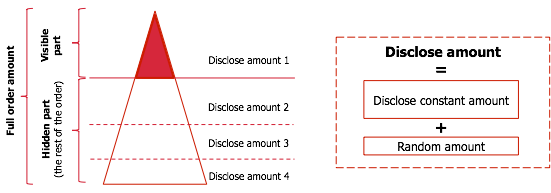

- Disclose and hidden order parts

When submitting an Iceberg order the client sets the full amount of order and the disclose constant amount (visible part). When the disclose amount is settled on the market, the next part emerges. It gets in the end of the line at the same price level. MOEX sets the minimum disclose amount of Iceberg.

- Iceberg orders are available for all Derivatives Market participants

Iceberg orders are available for all instruments (futures, options, calendar spreads) and for all clients.

ICEBERG ORDER PARAMETERS

In addition the client indicates in the order parameters the following (all the parameters are positive integers):

| 1 | 2 | 3 |

|---|---|---|

| Full order amount | The amount of the constant disclose (visible) amount or the percentage of the full order amount | The deviation amplitude for random disclose amount in percentage |

| FullAmount | DiscloseConstAmount или DiscloseConstAmount% If we need to calculate DiscloseConstAmount%, the formula is: DiscloseConstAmount = Round(FullAmount* DiscloseConstAmount%/100, 0) |

VarianceAmount или VarianceAmount% The random amount for a disclose part – the random variable with equal distribution from the range: [-Round(DiscloseConstAmount * VarianceAmount%/100, 0); Round(DiscloseConstAmount * VarianceAmount%/100, 0)]. By default: VarianceAmount% = 0%. |

ICEBERG ORDER PECULIARITIES

- The Initial Margin is blocked for the full amount of the order, but not for the disclose amount

- Iceberg orders enable to set the lifespan of an order

- When cancelling an Iceberg order – both disclose part and hidden part disappear

- MoveOrder transaction enables to resubmit an Iceberg with the price changed. If some order parameters are not stipulated, then the new order adopts them from the previous order.

- Transactions Cancel on Disconnect, Cancel on Drop Copy Disconnect, User Kill Switch apply to Iceberg orders

MATERIALS

APPENDIX: ICEBERG ORDER PARAMETERS IN THE TRADING SYSTEM

VarianceLimit% = 20%

Таблица SmallestAmount(Undrln, Type):

| Basic asset | Type of instrument | The minimum amount of a disclose part (in contracts) |

|---|---|---|

| Si | F | 500 |

| RTS | F | 150 |

| BR | F | 300 |

| SBRF | F | 250 |

| ED | F | 400 |

| Eu | F | 200 |

| GAZR | F | 250 |

| GOLD | F | 200 |

| * | * | 100 |

If the basic asset and/or type of instrument are not stipulated in the table, then the value of * is applied

CONTACTS

Derivatives Market Department of Moscow Exchange

tel: +7 (495) 363-3232

e-mail: derivatives@moex.com