Fees of Derivatives Market of the Moscow Exchange

- Overview

- Exchange and clearing fees

- Commission for execution

- Commission for execution of one-day futures with auto-prolongation

- Transaction fees

- Documents

Currently, participants are paid the following types of commission:

- Exchange fee for transactions - is charged by PJSC Moscow Exchange

- Clearing commission - charged by NCO NCC (JSC)

- Clearing commission for execution of transactions - charged by NCO NCC (JSC)

- Clearing commission for execution of one-day settlement futures contracts with auto-prolongation - charged by NCO NCC (JSC)

- Transaction fees

A maker transaction is a transaction concluded on the basis of an application, the registration time of which is earlier than the registration time of the counter application.

A taker transaction is a transaction concluded on the basis of an application, the registration time of which is later than the registration time of the counter application.

!! For maker transactions in the unaddressed mode, the exchange and clearing commission for transactions is zero.

The final commission consists of the amount of exchange and clearing commissions.

Base rates for groups of contracts by types of underlying assets

| Unaddressed requests for taker | ||||||

| Exchange | Clearing | Total | ||||

| Futures BaseFutFee, % |

Options BaseOptFee, %* |

Futures BaseFutFee, % |

Options BaseOptFee, %* |

Futures, % | Options, % | |

| FX Contracts | 0,002655 | 1,265 | 0,001965 | 0,935 | 0,00462 | 2,2 |

| Interest rate contracts | 0,009486 | 1,265 | 0,007014 | 0,935 | 0,01650 | 2,2 |

| Equity contacts | 0,011385 | 1,265 | 0,008415 | 0,935 | 0,01980 | 2,2 |

| Index contracts | 0,003795 | 1,265 | 0,002805 | 0,935 | 0,00660 | 2,2 |

| Commodity contracts | 0,007590 | 1,265 | 0,005610 | 0,935 | 0,01320 | 2,2 |

| Addressed requests | ||||||

| Exchange | Clearing | Total | ||||

| Futures BaseFutFee, % |

Options BaseOptFee, %* |

Futures BaseFutFee, % |

Options BaseOptFee, %* |

Futures, % | Options, % | |

| FX Contracts | 0,000885 | 1,265 | 0,000655 | 0,935 | 0,00154 | 2,2 |

| Interest rate contracts | 0,003162 | 1,265 | 0,002338 | 0,935 | 0,00550 | 2,2 |

| Equity contacts | 0,003795 | 1,265 | 0,002805 | 0,935 | 0,00660 | 2,2 |

| Index contracts | 0,001265 | 1,265 | 0,000935 | 0,935 | 0,00220 | 2,2 |

| Commodity contracts | 0,002530 | 1,265 | 0,001870 | 0,935 | 0,00440 | 2,2 |

* valid until 19:00 Moscow time on April 03, 2024 inclusive.

Futures

| FutFee | Exchange fee (RUB); |

| FutPrice | Futures price; |

| W/R | Tick value/tick (RUB); |

| BaseFutFee | Basic fee rate for the group |

Example 1:

The settle price of the previous clearing on the Brent oil futures (FutPrice) is 86.51 USD

Price step (R) = 0.01

The cost of the price step (W) = 7,51337

Futures belongs to the group of "Commodity Contracts", therefore, for the taker in the unaddressed mode, the exchange commission rate is 0.007590%, the clearing rate is 0.00561%.

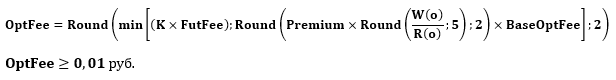

Margin options on futures contracts

| K | 0.4 - for the period from April 03, 2023 (from 19:00 Moscow time) to April 03, 2024 inclusive (until 19:00 Moscow time); |

| FutFee | the amount of the fee for the conclusion of the futures, which is the basic asset of the option (in rubles); |

| W/R | Tick value/tick (RUB); |

| Premium | the option premium (in the units of the option price); |

| BaseOptFee | Basic fee rate for the group. |

Example 2:

The theoretical price of the CALL option for Brent crude futures following the results of yesterday evening clearing (Premium) is 6.99 US dollars

Price step (R) = 0.01

The cost of the price step (W) = 7,51337

BaseOptFee (exchanges) = 1.265%, BaseOptFee (clear)= 0.935%

FutFee (exchange) =4.93, FutFee (clear)=3.65 (see Example 1)

The commission will be the smallest of the double futures fee and calculated from the premium:

Premium options

| PriceRub | settle price of the underlying asset, determined by the results of the clearing session; | ||||||||||||||

| LotVolume | lot; | ||||||||||||||

| W/R | Tick value/tick (RUB); | ||||||||||||||

| Round | mathematical rounding function with a given accuracy; | ||||||||||||||

| K | additional coefficient for transactions based on address requests:

for transactions based on unaddressed requests registered later than the corresponding allowable counter request:

|

||||||||||||||

| Premium | the value of the Theoretical option price, which is determined based on the results of yesterday evening clearing. For options concluded on the first trading day, the Premium value is equal to the value of the Theoretical option Price; | ||||||||||||||

| BaseOptFee | the value of the base rate of the tariff for the corresponding group. |

| Базисный актив | Unaddressed requests for taker | Addressed requests | ||||||

| Exchange | Clearing | Exchange | Clearing | |||||

| K,% | BaseOptFee, % | K,% | BaseOptFee, % | K,% | BaseOptFee, % | K,% | BaseOptFee, % | |

| Equity contacts* | 0,006 |

0,69 |

0,006 |

0,51 |

0,002 |

0,23 |

0,002 |

0,17 |

| FX сontracts* | ||||||||

| Commodity contracts* | ||||||||

| Index contracts* | ||||||||

* valid until 19:00 Moscow time on April 03, 2024 inclusive.

Calendar spread – simultaneous purchase and sale of futures with one underlying asset and different execution dates based on "Calendar Spread" Orders.

Read more – Tariffs of the Moscow Futures Market Exchange

The clearing commission for the execution of contracts and the clearing tariffs for the services of the NCO NCC (JSC) are established in accordance with the NCC Tariffs (Sections II and V).

There is a separate fee for the execution of one-day settlement futures contracts with auto-prolongation. For more information: NCC Tariffs (Section V).

Calculation algorithm applied to Additional fees and charges stipulated in the Integrated IT Service Agreement, coefficients for calculation of the fees are given in the Parameter List.

Read more about the erroneous transaction fee

Read more about the Flood Control error fee