Innovations 2024

Innovations in the foreign exchange market since November 11

General information

In the foreign exchange market, in order to stabilize the exchange rate in case of sharp price movements during trading, which led to the need to shift the current boundaries after the expiration of the set waiting time for the market, a Price Adjustment Auction is introduced on the bar.

The start of the Price Adjustment Auction is announced immediately after the automatic border shift, along with a message about the border shift. The Price Adjustment Auction is launched for all spot instruments of the currency pair for which the boundaries have shifted.

During the Price Adjustment Auction, bids submitted using the TWAP algorithm are not accepted by the Trading System. The unrealized volumes in such applications will be distributed to subsequent iterations from this package according to the standard procedure.

Trading schedule

| Price Adjustment Auction | ||||

|---|---|---|---|---|

| Instruments | Trading modes | The period of time during which the Price Update Auction may begin (t) |

Collection period for orders |

The phase of random end of the auction |

| TOD instruments | Main Board | 10:00:00 – 17:34:30 | t + 00:10:00 | t + 00:10:00 – t + 00:10:30 |

| TOM and SPT instruments | 10:00:00 – 18:49:30 | t + 00:10:00 | t + 00:10:00 – t + 00:10:30 |

|

| 18:49:30 – 18:58:00 | before 18:59:30 |

18:59:30 – 19:00:00 |

||

* In the period from 17:34:30 to 17:45:00, in case of the occurrence of events that should lead to a shift in the boundaries of the price corridor in accordance with the Methodology for determining the risk parameters of the foreign exchange market and the precious metals market of Moscow Exchange by the NCC, the end time of trading on the instruments of such currency pair in the Main Board is the moment of occurrence of such an event.

Innovations in the foreign exchange market since November 2

Changing the surcharge parameters on weekends and holidays

In order to optimize the work of the algorithms of Bidders on weekends and holidays, as well as on working days postponed to weekends, the number of free applications covered by a turnover of 1 million rubles is increasing from 200 to 400. In connection with the innovation, a change is introduced to the formula for calculating the surcharge for weekends and holidays: the coefficient of accounting for turnover on transactions becomes 0.04% instead of 0.02% previously.

Innovations of the FX market since October 14

Changing the mechanism for limiting aggressive orders

The mechanism for limiting aggressive orders is changed in the case of the lack of opposite orders. In cases when a remainder is formed for the order, while the price at which this remainder will be queued exceeds the current limit described in the Order Parameters, such a remainder will be removed.

Example:

For instrument СNYRUB_TOM limit order to buy at 13,20 RUB for 100 lots is placed. At the moment there is only one opposite order at 13,00 RUB for 50 lots is placed. The current price limit for the order = 13,00*(100%+1%) = 13,13 RUB

Before:

Order will be done for 50 lots at 13,00 RUB. Another 50 lots will be placed in the Trading System.

After:

Order will be done for 50 lots at 13,00 RUB. Another 50 lots will be rejected in the Trading System.

Useful links:

Innovations of the FX market since September 23

New analytical report - extract from the transaction register

A report displaying compressed trades in each of the instruments represented on the FX Market, except for the LICU settlement mode and OTC modes, starts to be generated for the traders.

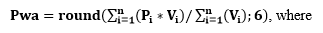

For deals made in one instrument, the total weighted average rate is calculated using the formula:

- Pi – the price in the i-th trade,

- Vi – the volume of the i-th trade, currency units of a lot,

- n – number of trades,

- round (x; 6) – function of mathematical rounding of the number X to the 6th decimal place.

To generate the report it is necessary to send an application to the Operational Department of the Exchange. The report is formed until 10:00 of the working day following the trades execution date.

The example of the generated report is given here.

Useful links:

Innovations of the FX market since June 17

Extension of trading time for TOD and TODTOM instruments until 19:00

Trading time of TOD and TODTOM instruments of all currency pairs is extended until 19:00. Cut-off time for fulfillment of liabilities by crediting funds remains unchanged. При этом время зачисления средств для исполнения обязательств остается без изменений. The current schedule for crediting funds can be found on the NCC page.

For short position in additional periods of trade sufficient funds in NCC are required, otherwise the position will forcibly be transferred to the next day. Buyers of currency will have an option to withdraw only during the next day.

Changes in Trading time from 17 June 2024:

| Currency pair | Instrument type | Trading modes | Trading hours |

|---|---|---|---|

| AMD/RUB USD/AMD KGS/RUB USD/KGS TJS/RUB USD/TJS KZT/RUB USD/KZT TRY/RUB USD/TRY ZAR/RUB USD/ZAR UZS/RUB EUR/RUB USD/EUR BYN/RUB |

T+0 | Main Board | 07:00 – 17:45 |

| Negotiated Board (different settlement codes) |

07:00– 19:00 | ||

| Negotiated Board (one settlement code) |

07:00 - 23:50 | ||

| T+0/t+1 | Main Board | 07:00 - 18:00 | |

| Negotiated Board (different settlement codes) |

07:00– 19:00 | ||

| Negotiated Board (one settlement code) |

07:00 - 23:50 |

Useful links:

- Trading Schedule FX and Precious Metals Markets

- Time Specification for Total Net Obligations /Net Claims

Reverse currency pairs in CPCL

New instruments TOD, TOM, TODTOM of currency pairs RUB/KZT, RUB/BYN, RUB/KGS, RUB/UZS are added in the CPCL.

| Instruments | Submission of offers in CPCL (pre-trade) | Conclusion of trades in CPCL (pre-and post-trade) |

|---|---|---|

| RUBUZS_TOD RUBUZSTDTM RUBKGS_TOD RUBKGSTDTM RUBKZT_TOD RUBKZTTDTM RUBBYN_TOD RUBBYNTDTM |

07:00 – 18:30 | 07:00 - 19:00 |

| RUBKZT_TOM RUBBYN_TOM RUBKGS_TOM RUBUZS_TOM |

07:00 – 23:00 | 07:00 - 23:50 |

Useful links:

Innovations of the FX market since June 3

Extension of trading time in Negotiation Board with different settlement codes

Trading time in Negotiated Board with different settlement codes will be extended since June 3.

Trading schedule FX and Precious Metals Markets since June 3:

- from 6:50 up to 7:00 –opening auction;

- from 7:00 up to 10:00 – Average weighted deals (instruments USDRUBWAP0, USDRUBWAPV, CNYRUB_WAP0 and CNYRUB_WAPV);

- from 7:00 up to 19:00 – Trading period of the Main Board;

- from 7:00 up to 23:50 – deals in Negotiated Board with one or different settlement codes and Clearing of OTC trades with CCP (CPCL mode).

Useful links:

Innovations of the FX market since March 18

Change of trading time for CNY and HKD

Trading time of CNY and HKD TOD and TODTOM instruments will be changed in the Main (CETS, CNGD) and Negotiated (CPCL) Boards since March 18.

However, the cut-off time of the correspondent bank for crediting funds to the NCC account does not change: https://www.nationalclearingcentre.ru/catalog/0218

Parameters of instruments:

| Board | Instrument | Trading mode | Trading time (before 18.03.2024) | Trading time (after 18.03.2024) |

|---|---|---|---|---|

| CETS | HKDRUB_TOD | TOD (T+0) | 07:00 – 10:45 11:02 – 17:45 |

07:00–17:45 |

| CNYRUB_TOD USDCNY_TOD |

07:00 – 12:15 12:32 – 17:45 |

|||

| HKD_TODTOM | O/N | 07:00 – 11:00 11:02 – 18:00 |

07:00 – 18:00 | |

| CNY_TODTOM USDCNYTDTM |

07:00 – 12:30 12:32 – 18:00 |

|||

| CNGD | HKDRUB_TOD USDHKD_TOD |

TOD (T+0) | 07:00 – 11:00 11:02 – 19:00 |

07:00–19:00 |

| CNYRUB_TOD USDCNY_TOD |

07:00 – 12:30 12:32 – 19:00 |

|||

| HKD_TODTOM USDHKDTDTM |

O/N | 07:00 – 11:00 11:02 – 19:00 |

||

| CNY_TODTOM USDCNYTDTM |

07:00 – 12:30 12:32 – 19:00 |

|||

| CPCL | HKDRUB_TOD USDHKD_TOD |

TOD (T+0) | Pre-trade: 07:00 - 10:30 Post-trade: 07:00 - 11:00 |

Pre-trade: 07:00 - 18:30 Post-trade: 07:00 - 19:00 |

| CNYRUB_TOD USDCNY_TOD |

Pre-trade: 07:00 - 12:00 Post-trade: 07:00 - 12:30 |

|||

| HKD_TODTOM USDHKDTDTM |

O/N | Pre-trade: 07:00 - 10:30 Post-trade: 07:00 - 11:00 |

||

| CNY_TODTOM USDCNYTDTM |

Pre-trade: 07:00 - 12:00 Post-trade: 07:00 - 12:30 |

Useful links:

Innovations of the Precious metals market since March 4:

The change of GLD/RUB price tick:

Since March 4 the price tick of GLD/RUB (Gold/Russian ruble) is changed:

- Price tick is changed for SPOT-instrument of GLDRUB_TOM for Main Board (CETS) from 0,01 to 0,1;

- Price tick is not changed for SPOT-instruments of GLD/RUB for other boards (CNGD CPCL, LICU and others);

Parameters of instruments:

| Instrument | Price tick before 04.03.23 | Price tick after 04.03.23 |

|---|---|---|

| GLDRUB_TOM | 0,01 | 0,1 |

Useful links:

Lot size Instrument

Innovations of the FX market since February 19:

Extension of trading time for BYN/RUB

Trading time of BYN/RUB TOD and TODTOM instruments will be extended in the Main (CETS, CNGD) and Negotiated (CPCL) Boards since January 22.

Parameters of instruments:

| Instrument | Trading mode | Trading time (after 22.01.2024) |

|---|---|---|

| BYNRUB_TOD | Main Board | 07:00 - 15:00 |

| Negotiated Board (different settlement codes) | 07:00 - 15:15 | |

| Negotiated Board (one settlement code) | 07:00 - 23:50, maintenance break 12:30:00 – 12:30:01 |

|

| Clearing of OTC trades with CCP (CPCL mode) | Conclusion of trades (pre-trade and post-trade): 07:00 - 15:15 Submission of offers in CPCL (pre-trade): 07:00 – 14:45 |

|

| BYN_TODTOM | Main Board, Negotiated Board (different settlement codes) |

07:00 - 15:15 |

| Negotiated Board (one settlement code) | 07:00 - 23:50, maintenance break 12:30:00 – 12:30:01 |

|

| Clearing of OTC trades with CCP (CPCL mode) | Conclusion of trades (pre-trade and post-trade): 07:00 - 15:15 Submission of offers in CPCL (pre-trade): 07:00 – 14:45 |

Useful links: