Sustainable Development and Social Responsibility

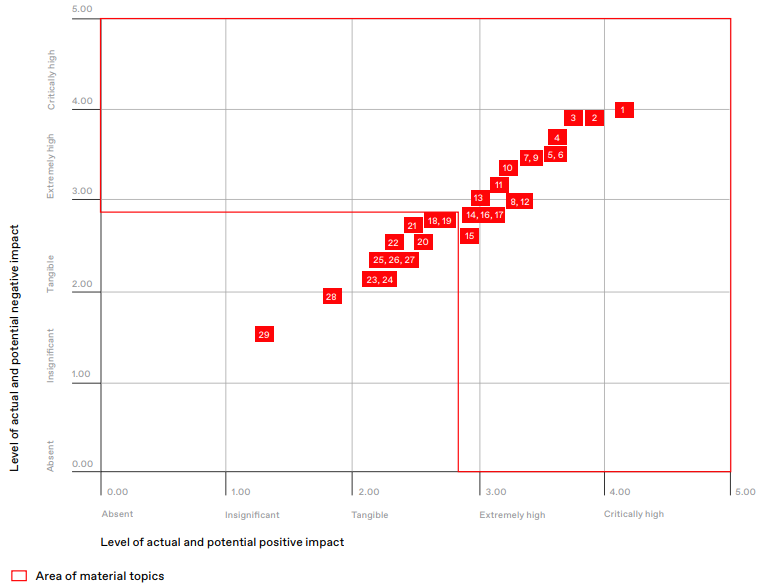

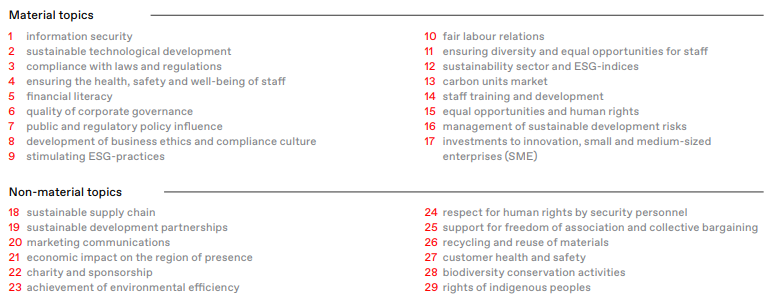

In 2022, Moscow Exchange made a comprehensive assessment of material topics, taking into consideration the opinions of key stakeholders. As a result of this assessment, 29 topics were identified; their significance was then evaluated according to the following principles:

- The new GRI Standards (2021) require distinguishing the sustainability topics by the significance of actual and potential, negative and positive impacts on the stakeholders.

- The integral rating of the material topic is calculated as the sum of the levels of positive and negative impact on the stakeholders.

- All of the material topics with an integral impact rating above 5.5 are rated as material.

- Indicators of non-material topics may be disclosed in the sustainability report but are not covered

by professional assurance.

Based on this analysis, the Group prepared a list of 17 topics that it deemed material and mandatory for disclosure. Information on other 12 topics has also been disclosed selectively.

Based on the results of prioritization, the list of material sustainability topics was approved by a decision of the Moscow Exchange Executive Board.

Based on the result of the materiality assessment and integration of ESG activities and projects into

Group’s 2024 strategy, MOEX Group has formulated a set of sustainability focus areas, that reflects its most significant ESG topics.

MOEX’s approach to formulating these overlapping areas was informed by the following criteria:

1. These focus areas are related to the most important ESG challenges, risks and opportunities that Moscow Exchange Group is facing and that are inherent to its industry;

2. These areas are important for MOEX stakeholders;

3. Focus areas are significant for MOEX because within these areas it can deliver the most positive impact as a company and as a financial infrastructure operator.

More detailed information on the progress in the implementation of the main areas of activity of MOEX Group may be found in its sustainability reports.

Moscow Exchange 2024 Sustainability Report

Sustainability report of Moscow Exchange 2023

Interactive sustainability report of Moscow Exchange 2023

ESG Databook

Sustainability report of Moscow Exchange 2022

Interactive sustainability report of Moscow Exchange 2022

Sustainability report of Moscow Exchange 2021

Interactive sustainability report of Moscow Exchange 2021

Sustainability report of Moscow Exchange 2020

Sustainability report of Moscow Exchange 2019