Derivatives Market Futures and Options Contract Code Specifications

Codes of derivative contracts have 2 unique codes:

- Short

- Long (Full code)

Codes are different for futures and options contracts. Each code consists of components that include all the necessary information about the contract.

Below are brief and complete futures and options contract codes with examples and lists of values.

Futures codes

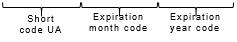

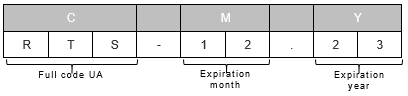

Short code

| C | M | Y | |||

|---|---|---|---|---|---|

Full code

| C | M | Y | ||||||

|---|---|---|---|---|---|---|---|---|

| - | - | |||||||

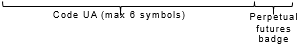

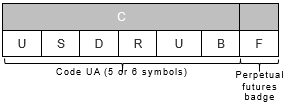

Perpetual futures code

| C | ||||||

|---|---|---|---|---|---|---|

| F | ||||||

Example 1:

RTS Index futures contract with expiration on 21.12.2023

Short code

Full code

Example 2:

Daily futures contract with automatic prolongation on USD/RUB

Perpetual futures code

Options codes

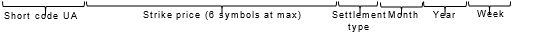

Short code

| C | P | K | M | Y | W | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Full code

| C | K | D | T | E | P | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

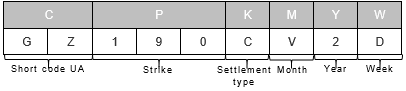

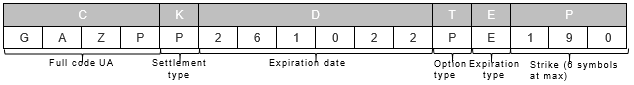

Example:

Weekly equity-style put option on Gazprom share with expiration at 26.10.2022 and strike price 190.

Short code

Full code

Codes of the underlying asset for futures and futures-style options (field "C")

| Contract's Group | Futures and Options codes(field "C") |

Code of the underlying asset |

Underlying asset |

|---|---|---|---|

| Indices | MX | MIX | MOEX Russia Index |

| MM | MXI | MOEX Russia Index (mini) | |

| MY | MOEXCNY | MOEX Russia Index (CNY) | |

| RI | RTS | RTS Index | |

| RM | RTSM | RTS Index (mini) | |

| VI | RVI | Russian Market Volatility | |

| HO | HOME | Moscow Real Estate Domclick Index | |

| OG | OGI | Oil&Gas MOEX Index | |

| MA | MMI | Metals & Mining MOEX Index | |

| FN | FNI | Financial MOEX Index | |

| CS | CNI | Consumer MOEX Index | |

| RB | RGBI | RGBI Index | |

| IMOEXF | IMOEXF | MOEX Russia Index (Daily Futures) | |

| IP | IPO | MOEX Index IPO | |

| Equities | AF | AFLT | Aeroflot (o.s.) |

| AL | ALRS | ALROSA (o.s.) | |

| CH | CHMF | Severstal (o.s.) | |

| FS | FEES | FGC UES (o.s.) | |

| GZ | GAZR | Gazprom (o.s.) | |

| GAZPF | GAZPF | Gazprom (o.s., Daily Futures) | |

| GK | GMKN | Norilsk Nickel (o.s.) | |

| HY | HYDR | RusHydro (o.s.) | |

| LK | LKOH | LUKOIL (o.s.) | |

| MN | MGNT | Magnit (o.s.) | |

| ME | MOEX | Moscow Exchange (o.s.) | |

| MT | MTSI | MTS (o.s.) | |

| NM | NLMK | NLMK (o.s.) | |

| NK | NOTK | NOVATEK (o.s.) | |

| RN | ROSN | Rosneft (o.s.) | |

| RT | RTKM | Rostelecom (o.s.) | |

| SP | SBPR | Sberbank (p.s.) | |

| SR | SBRF | Sberbank (o.s.) | |

| SBERF | SBERF | Sberbank (o.s., Daily Futures) | |

| SG | SNGP | Surgutneftegas (p.s.) | |

| SN | SNGR | Surgutneftegas (o.s.) | |

| TT | TATN | Tatneft (o.s.) | |

| TP | TATP | Tatneft (p.s.) | |

| TN | TRNF | Transneft (p.s.) | |

| VB | VTBR | VTB Bank (o.s.) | |

| MG | MAGN | MMK (o.s.) | |

| PZ | PLZL | Polus (o.s.) | |

| YD | YDEX | Yandex (o.s.) | |

| AK | AFKS | AFK Systema (o.s.) | |

| IR | IRAO | Inter RAO Group (o.s.) | |

| PO | POLY | Polymetal International (o.s.) | |

| PI | PIKK | PIK (o.s.) | |

| SE | SPBE | SPB Exchange (o.s.) | |

| RL | RUAL | United Company Rusal (o.s.) | |

| PH | PHOR | PhosAgro (o.s.) | |

| SS | SMLT | Samolet Group (o.s.) | |

| MC | MTLR | Mechel (o.s.) | |

| RE | RSTI | Rosseti (o.s.) | |

| SO | SIBN | Gazprom Neft (o.s.) | |

| TI | TCSI | TKS Holding (o.s) | |

| VK | VKCO | VK (o.s.) | |

| SF | SPYF | SPY ETF Trust | |

| NA | NASD | Invesco QQQ ETF Trust Unit Series 1 | |

| PS | POSI | Group Positive (o.s.) | |

| SX | STOX | iShares Core EURO STOXX 50 UCITS ETF EUR (Dist) | |

| HS | HANG | Tracker Fund of Hong Kong ETF | |

| DX | DAX | iShares Core DAX UCITS ETF (DE) | |

| N2 | NIKK | iShares Core Nikkei 225 ETF | |

| IS | ISKJ | Artgen (o.s.) | |

| WU | WUSH | WHOOSH Holding (o.s.) | |

| MV | MVID | M.video (o.s.) | |

| CM | CBOM | Credit bank of Moscow (o.s.) | |

| SZ | SGZH | Segezha Group (o.s.) | |

| FL | FLOT | Sovcomflot (o.s.) | |

| BS | BSPB | BSPB (o.s.) | |

| BN | BANE | Bashneft (o.s.) | |

| KM | KMAZ | Kamaz (o.s.) | |

| AS | ASTR | Astra Group (o.s.) | |

| S0 | SOFL | Softline (o.s.) | |

| SC | SVCB | Sovkombank (o.s.) | |

| R2 | R2000 | iShares Russell 2000 ETF | |

| DJ | DJ30 | DJ Industrial Average ETF Trust | |

| BB | ALIBABA | Alibaba Group Holding Limited ADR | |

| BD | BAIDU | Baidu Inc. ADR | |

| RA | RASP | Raspadskaya (o.s.) | |

| FE | FESH | DVMP (o.s.) | |

| RU | RNFT | Russneft (o.s.) | |

| LE | LEAS | Evroplan (o.s.) | |

| EM | EM | iShares MSCI Emerging Markets ETF | |

| SH | SFIN | CFI | |

| TB | T | T-Technology | |

| NB | BELUGA | NovaBev | |

| X5 | X5 | Corporate center X5 | |

| Interest Rates | RR | RUON | RUONIA |

| MF | 1MFR | RUSFAR | |

| FXs | CR | CNY | CNY/RUB |

| Eu | Eu | EUR/RUB | |

| Si | Si | USD/RUB | |

| USDRUBF | USDRUBF | USD/RUB (Daily Futures) | |

| EURRUBF | EURRUBF | EUR/RUB (Daily Futures) | |

| CNYRUBF | CNYRUBF | CNY/RUB (Daily Futures) | |

| TY | TRY | TRY/RUB | |

| HK | HKD | HKD/RUB | |

| AE | AED | AED/RUB | |

| I2 | INR | INR/RUB | |

| KZ | KZT | KZT/RUB | |

| AR | AMD | AMD/RUB | |

| BY | BYN | BYN/RUB | |

| ED | ED | EUR/USD | |

| AU | AUDU | AUD/USD | |

| GU | GBPU | GBP/USD | |

| CA | UCAD | USD/CAD | |

| CF | UCHF | USD/CHF | |

| JP | UJPY | USD/JPY | |

| TR | UTRY | USD/TRY | |

| UC | UCNY | USD/CNY | |

| UT | UKZT | USD/KZT | |

| EC | ECAD | EUR/CAD | |

| EG | EGBP | EUR/GBP | |

| EJ | EJPY | EUR/JPY | |

| Commodities | BR | BR | BRENT |

| CL | CL | Light Sweet Crude Oil | |

| GD | GOLD | Gold | |

| GL | GL | Gold (RUB) | |

| GLDRUBF | GLDRUBF | Gold (Daily Futures) | |

| PD | PLD | Palladium | |

| PT | PLT | Platinum | |

| SV | SILV | Silver | |

| SA | SUGR | Raw Sugar | |

| SL | SLV | Silver (deliverable) | |

| AM | ALMN | Aluminum | |

| Co | Co | Copper | |

| GO | GLD | Gold (deliverable) | |

| Nl | Nl | Nickel | |

| Zn | Zn | Zinc | |

| NG | NG | Natural Gas | |

| WH | WH4 | Wheat delivery | |

| W4 | WHEAT | Wheat | |

| Su | SUGAR | Sugar | |

Codes of the underlying asset for the European option (field "C")

| Contract's Group | Code of the underlying asset |

Code of the underlying asset in the Derivatives market |

Underlying asset |

|---|---|---|---|

| Equities | AL | ALRS | ALROSA (o.s.) |

| АК | AFKS | AFK Systema (o.s.) | |

| CH | CHMF | Severstal (o.s.) | |

| GZ | GAZP | Gazprom (o.s.) | |

| GK | GMKN | Norilsk Nickel (o.s.) | |

| IR | IRAO | Inter RAO Group (o.s.) | |

| LK | LKOH | LUKOIL (o.s.) | |

| MG | MAGN | MMK (o.s.) | |

| MN | MGNT | Magnit (o.s.) | |

| MC | MTLR | Mechel (o.s.) | |

| NM | NLMK | NLMK (o.s.) | |

| NK | NVTK | NOVATEK (o.s.) | |

| PH | PHOR | PhosAgro (o.s.) | |

| PI | PIKK | PIK (o.s.) | |

| PZ | PLZL | Polus (o.s.) | |

| PO | POLY | Polymetal International (o.s.) | |

| RN | ROSN | Rosneft (o.s.) | |

| RL | RUAL | United Company Rusal (o.s.) | |

| SR | SBER | Sberbank (o.s.) | |

| SP | SBERP | Sberbank (p.s.) | |

| SS | SMLT | Samolet Group (o.s.) | |

| SN | SNGS | Surgutneftegas (o.s.) | |

| T | TB | T-Technologies (o.s.) | |

| VK | VKCO | VK (o.s.) | |

| VB | VTBR | VTB Bank (o.s.) | |

| YD | YDEX | Yandex (o.s.) | |

| TT | TATN | Tatneft (o.s.) | |

| MT | MTSS | MTS (o.s.) | |

| PS | POSI | Group Positive (o.s.) | |

| ME | MOEX | Moscow Exchange (o.s.) | |

| IS | ISKJ | Artgen (o.s.) | |

| SC | SVCB | Sovkombank (o.s.) | |

| AS | ASTR | Astra Group (o.s.) | |

| DI | DIAS | Diasoft (o.s.) | |

| MO | MSNG | Mosenergo (o.s.) | |

| SE | SPBE | SPB Exchange (o.s.) | |

| SO | SIBN | Gazprom Neft (o.s.) | |

| FX Contracts | Si | Si | USD-RUB Exchange Rate |

| Eu | Eu | EUR/RUB Exchange Rate | |

| CR | CNY | CNY/RUB Exchange Rate | |

| Commodities | GL | GL | Gold |

| Indices | IM | IMOEX | MOEX Russia Index |

Coding of options strike price (field "P")

For options on futures it is the price of underlying asset (futures price) that is noted in the field "strike price". The futures price in its turn is the product of an underlying asset’s price and lot size.

For premium stock options, the strike price field indicates the unit price of the underlying asset.

Coding of settlement type in short code (field "К")

| Symbol in short code |

Underlying asset | Category | Settlement type |

|---|---|---|---|

| A | Futures | American | Equity-style options |

| B | Futures | American | Futures-style options |

| С | Share, currency | European | Equity-style options |

Full Code Settlement type (field "К")

| Symbol in short code | Settlement type |

|---|---|

| P | Equity-style |

| M | Futures-style |

Full Code Option type (field "T")

| Symbol in short code | Option type |

|---|---|

| С | Call |

| Р | Put |

Full Code Expiration type (field "E")

| Symbol in short code | Expiration type |

|---|---|

| A | American |

| E | European |

Coding of settlement month (field "M")

| Futures | Options | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Coding of settlement year (field "Y")

The settlement year for futures and options is coded with one digit from 0 to 9.

4 – 2024,

5 – 2025,

6 – 2026.

Coding of weekly option sign (field "W")

| Field Code | Weekly Options |

|---|---|

| null | Monthly or quarterly option |

| A | Weekly option expiring on the first week of the month |

| B | Weekly option expiring on the second week of the month |

| С | Weekly option expiring on the third week of the month |

| D | Weekly option expiring on the fourth week of the month |

| E | Weekly option expiring on the fifth week of the month |

Algorithm for determining values of fields Y, M and W of short code of a weekly option:

- Determine the Thursday of the week with the expiration date

- Y value is based on the year of the Thursday

- M value is based on the month of the Thursday

- W value is based by the ordinal number of this Thursday in the month

Example 1:

Weekly call option on RTS Index with a strike of 130000 expires on Monday, 30 December 2019. The Thursday of the week (2 January 2020) is not a trading day. The expiration was moved to the closest preceding trading day.

Short code: RI130000BA0A, since the Thursday is in January 2020 and it is the first Thursday of the month.

Full code: RTS-1.20M301219CA 130000

Example 2:

Weekly call option on SBER with a strike of 240 expires on Wednesday, 31.01.2024.

The system encodes such series as February, because the Thursday of this week falls in February.

Code of the month: B (February)

Week code: A (1st-week of the month). The Thursday closest to the expiration date of 31.01.2024 is 01.02.2024, i.e. already in February

Short code: SR240BCB4A

Full code: SBERP310124CE240

Example 3:

The Derivatives market provides the possibility of entering option contracts with zero and negative strikes. An example of their encoding for a monthly call option on the July Brent crude oil futures expires on June 25, 2020 with a strike of -10.

Short code: BR-10BF0

Full code: BR-7.20M250620СA -10

In case of a zero strike (0) for a similar contract:

Short code: BR0BF0

Full code: BR-7.20M250620СA 0